Auto Rollover IRAs

Plan participants missing? You’ve found a solution.

Auto Rollover IRAs

When employees move on, they often leave retirement funds behind. For retirement Plan Sponsors, it can be difficult and time-consuming to track down missing and non-responsive participants. Lingering 401(k) balances left in your company’s retirement plan can also be an administrative burden. The Department of Labor has specific rules on how you treat funds for missing participants.

Let GoldStar Trust take over, at no cost to you.

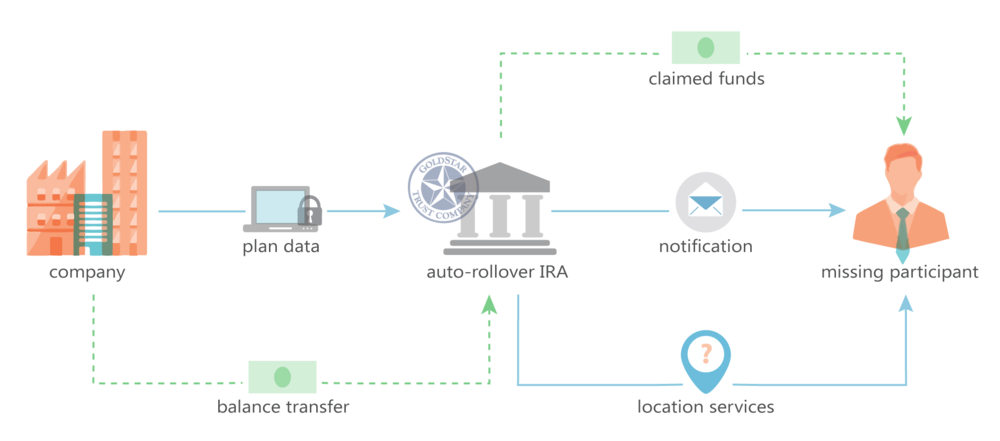

With GoldStar’s Automatic Rollover program, retirement Plan Sponsors can outsource administration of missing participant accounts with balances of $5,000 or less. As the IRA custodian, GoldStar Trust becomes responsible for locating missing participants, fulfilling reporting requirements, and responsibly holding funds.

Key Program Benefits

- Reunite employees with their money

- Transfer IRS reporting requirements

- No cost to Plan Sponsor

- Reduce retirement plan costs

- Reduce liabilities

- Satisfy fiduciary responsibilities

It’s your responsibility; GoldStar can help.

Before retirement plan savings of missing participants can be transferred to another custodian, you first have to demonstrate what you’ve done to locate them. The Department of Labor allows Plan Sponsors a “Safe Harbor” for rolling missing participant account balances to an IRA custodian. We can help you do this.

Safe Harbor IRA Requirements

The fiduciary Safe Harbor provides guidelines under which the Plan Sponsor can implement an Automatic Rollover program with the knowledge that his or her fiduciary responsibilities are being satisfied. These conditions are:

- The Plan Sponsor must enter into an Automatic Rollover Agreement with an IRA custodian.

- Account balances automatically rolled over can’t exceed $5,000.

- The investment product (once the balance is transferred to the IRA custodian) must be a reasonably liquid, conservative investment designed to preserve principal.

- The Plan Sponsor must inform all participants of the Automatic Rollover process and investment products offered.

- Fees and expenses charged to the account by the IRA custodian must be reasonable (not exceeding those of its comparable IRAs).

Why GoldStar Trust?

GoldStar Trust Company has been servicing IRA customers since 1989. With GoldStar as custodian, you’re leaving former employees in good hands. Contact us for more information or for an Automatic Rollover IRA Services Agreement to get started.